Blockchain networks are advertised as decentralised and trustless, yet scale has continued to be a persistent issue. With the increased transaction volumes, congestion, high charges and slow confirmations are posing threats to usability and liquidity. When networks are not executing as advertised, investors and developers are quick to detect and move to other faster chains, users lose interest, and the overall system becomes ineffective. This has resulted in the development of the zero knowledge rollups, a technology that achieves greater throughput without reducing security, privacy or finality.

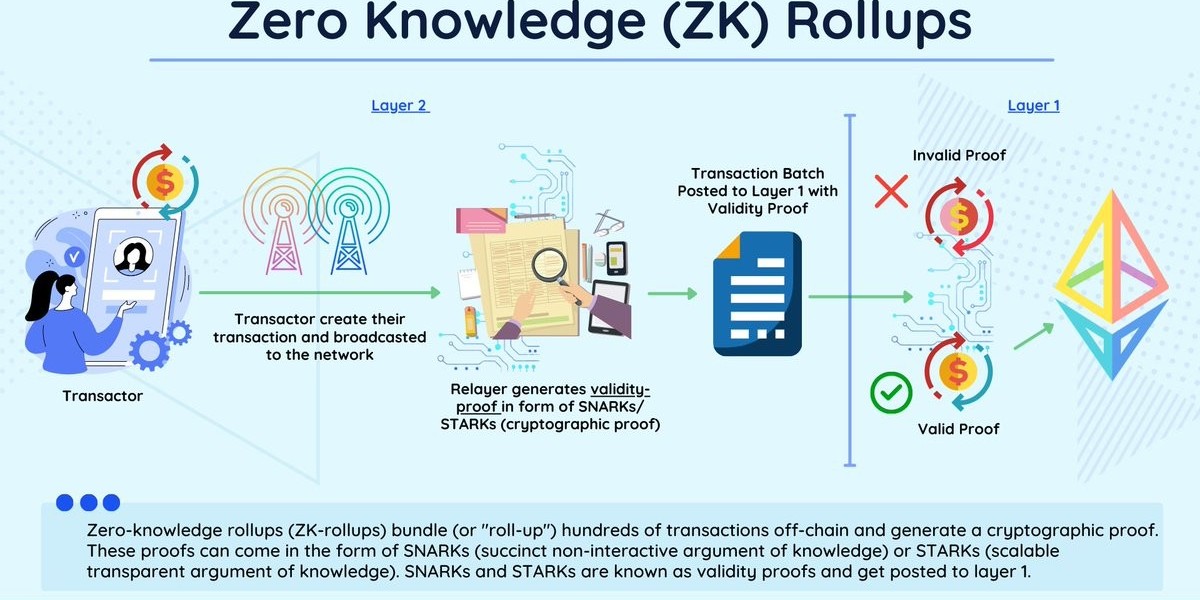

Zero knowledge rollups are not only attractive in terms of performance. Markets prefer predictability and resilience and these rollups place verifiable proofs at the core of the blockchain infrastructure. They enable networks to off-chain thousands of transactions, proving them through short cryptographic proofs, and verify their correctness on-chain. It is an effective combination of both technical bottlenecks and the market psychology that builds upon confidence in the reliability of the network.

The Zero Knowledge Rollup Transformation of Scaling

The classical layer-two solutions can commonly make a trade-off between speed, security and decentralization. Such optimistic rollups as the one above necessitate waiting times to process the possible fraud evidence, postponing finality and creating uncertainty. On the other hand, zero knowledge rollups provide instant verification by providing succinct proofs which are intrinsically trustless. It guarantees privacy and integrity of off-chain transactions without exposing sensitive information.

This mechanism minimizes systemic risk in terms of an investor. The providers of liquidity, traders, and developers may be confident that settlement will be quick and without compromise and delay. According to behavioral economics, systems that can be predicted and verified will be more engaging and capital resource allocation will be encouraged. Zero knowledge rollups meet these preferences, and the result of the ecosystem is confidence as well as activity scale increase alongside network throughput.

Economic and Operational Benefits

The economic efficiency is directly affected by scalability. Exorbitant charges and slowness of confirmation represent implicit capital and user taxes. With the use of zero knowledge rollups, these costs are greatly minimized, and microtransactions, interactions with DeFi, and NFTs transfers become economically viable at scale. This brings about an increase in bandwidth that can be utilized and widens the participation that is rewarded by markets in terms of greater adoption and network effect.

Operationally, zero knowledge rollups are easy to integrate, both on the developer side and the institution side. Complex smart contracts may be issued off-chain and authenticated on-chain, without revealing any proprietary logic or personal user information. This not only minimizes compliance and audit overhead but also ensures verifiability, establishing a frictionless setting to innovation as well as regulated participation. In the long run, the efficiencies are converted into reduced overhead and increased network utility.

Security and Privacy Issues

Security and privacy are also considered as conflicting goals in blockchain design, yet zero knowledge rollups are a graceful way to address them. Networks minimize attack surfaces through a single proof that finalizes many transactions. The information on sensitive transactions is kept secret, which prevents the risks of data leakage or exposure. This design that is privacy preserving is especially precious in the case of financial markets where institutional actors favor discretion over verifiable correctness.

Participants are more confident to behave when systems reduce the exposure to unnecessary cases and ensure results. The trust is supported not by promises and reputational assumptions, but by cryptographic proof. The psychological impact is immense: when it is proven to be correct with zero disclosure, participants distribute capital more easily, as well as engage in a longer commitment.

Long-Term Market Impacts

Taking a step into the zero knowledge rollups is an indicator of the maturity of blockchain ecosystems. Application of networks enables networks to accommodate more weight without compromising security, privacy, and finality. The ability lures both retail and institutional players, makes the network more efficient, and pushes developers to create more advanced applications. Liquidity, adoption, and resilience also increase simultaneously.

These improvements are reacted to by the markets predictably. With reduction in friction and enhancement of verifiable trust, transaction velocity increases, participation expands and systemic risk reduces. Zero knowledge rollup networks are good to match technological ability with market demand in a self-reinforcing spiral of trust, adoption, and advancement.

Conclusion

One of the most important challenges associated with blockchain scaling is the need to implement networks with high throughput without sacrificing security or privacy. zero knowledge rollups are the solution to this problem because they compress transactions into verifiable proofs and enable high throughput whilst preserving finality and confidentiality.

To developers, investors, and institutions, the use of zero knowledge rollups lowers friction, builds trust and increases economic opportunity. Scalable, secure, and private execution is realised in networks based on this technology to address technical and market demands. Zero knowledge rollups by making verification not to demand exposure provide a strong foundation of long-term development, liquidity/liquidity and trust in decentralized ecosystems.