The Udyam Registration Portal is the official government platform for registering MSMEs in India. Udyam registration Launched by the Ministry of MSME, it replaced the old Udyog Aadhar Memorandum (UAM) Udyam Registration has simplified the classification of business and ensures easy access to all government benefits, such as subsidies, priority sector lending ,easy loan approvals, etc.

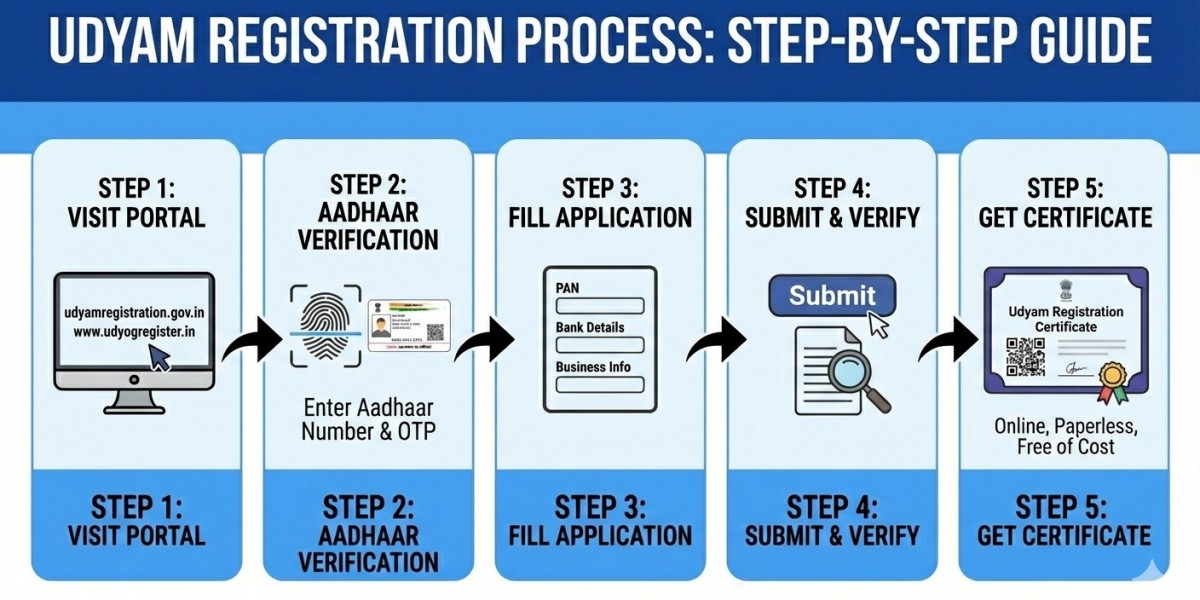

Udyam registration process step-by-step:-

1. Visit the Official Portal: To start the registration process, go to the official Udyam Registration

2. Fill the form :- Enter the business name, address, mobile number, email and bank account details.

3. Self-Declaration : Confirm your investment and turnover details

4. Final Submission : Review all information and click Submit and Get Final OTP. After entering the OTP, you will get your Udyam registration Number.

5. Print Udyam Certificate :- It takes few days for the system to verify the data. After that you can print your udyam certificate in same portal.

Micro, Small, and Medium Enterprises what we call (MSMEs) play a crucial role in driving the Indian economy. They create a large number of jobs for Indian people and aid in the financial growth of India. The government has introduced the Udyam Registration to support MSMEs. Udyam registration of small businesses opens the door for so many government schemes and subsidies here are some benefits of udyam registration:-

1. Official recognition by the government:

Udyam Registration provides formal recognition from the ministry of MSME. That means your startup is officially listed as MSME (Micro Small Medium Enterprise).

2. Priority in Governments Tenders: Small Business registered under Udyam Certification is given preference in government tenders. That makes it easier to get contracts from platforms like E-Marketplace

3. Increased trust with Bank and NBFC: Bank and NBFC find Udyam registered business less risky therefore registered MSMEs can get collateral free loan with Lower Interest rates, flexible repayments terms and faster and smoother Loan approval.

4. Tax Benefits and Exemptions: MSMEs registered with Udyam can carry forward (MAT) Minimum Alternate Tax up to 15 years (earlier which was only 10 years and) get rebates on direct taxes. That will reduce the operational cost of business.

5. Protection against delayed payment: Udyam registration protects small businesses from delayed payments by larger businesses. The government has come up with a mechanism to protect MSMEs from delayed payments by larger businesses. That helps MSMEs to have good financial stability and mentioned better cash flow.

6. Loan with less collateral and low Interest rate: Udyam registration provides easy access to finance. Udyam certified Business find it easy to secure a loan from Banks and other financial Institutions. Generally that loan has lower interest rates and also very less collateral required. That allows them to manage working capital and expand their business

7. Simplified Tax and Compliance : Udyam registration makes tax filing and regulatory compliance easy, especially when databases integrate with GST and PAN. Being a registered MSME helps in financial tracking, better organization and also better coordination with tax consultants

8. Support available for Diverse Business Types: Udyam Registration inclusively covers proprietorships, partnerships, (HUF) Hindu Undivided Families, trusts and societies and also manufacturing service retail and wholesale This wide range of eligibility ensure that all small businesses, including startups and women/ST/SC entrepreneurs, can be benefited. This scheme provides loans up to Rs2 Crore for first-time entrepreneurs