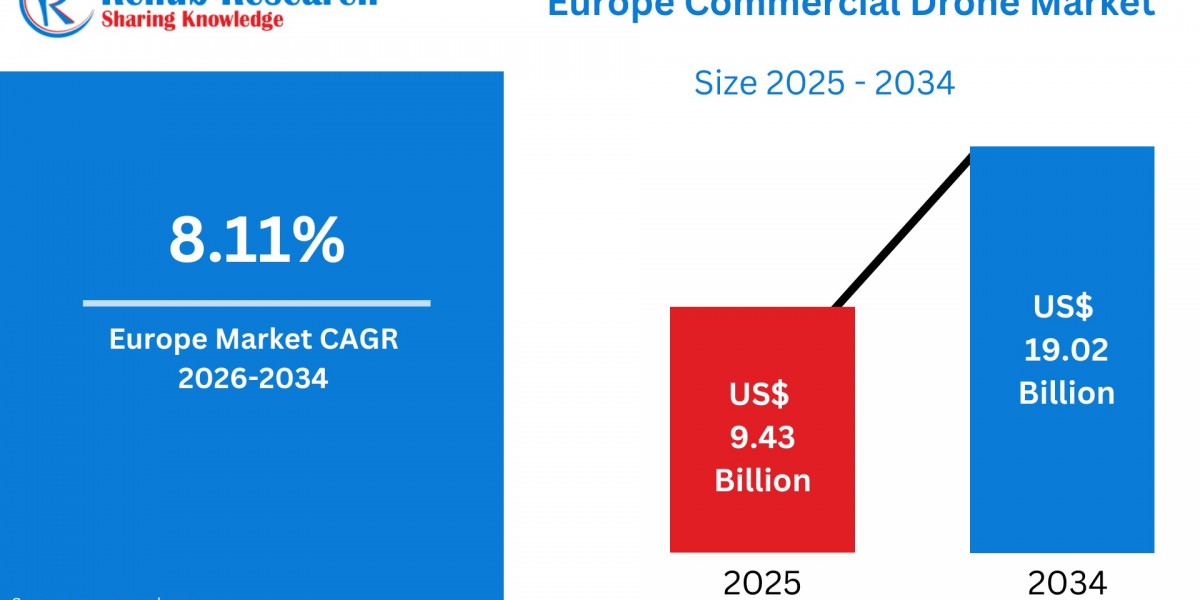

Europe Commercial Drone Market Size & Forecast (2026–2034)

According to Renub Research Europe commercial drone market is entering a period of strong and sustained growth, driven by rapid digital transformation across industries, supportive regulatory frameworks, and rising demand for real-time aerial data. The market is projected to expand from US$ 9.43 billion in 2025 to US$ 19.02 billion by 2034, registering a compound annual growth rate (CAGR) of 8.11% during the forecast period from 2026 to 2034.

Commercial drones are increasingly being adopted across construction, agriculture, logistics, public safety, energy, environmental monitoring, and media applications. Advancements in drone hardware, sensor technologies, artificial intelligence, and automation are enabling more precise, cost-effective, and scalable operations. Europe’s emphasis on sustainability, smart infrastructure, and industrial modernization further reinforces the long-term growth outlook for the commercial drone ecosystem.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=europe-commercial-drone-market-p.php

Overview of the Commercial Drone Market in Europe

A commercial drone refers to an unmanned aerial vehicle (UAV) designed specifically for professional and industrial applications rather than recreational use. These drones are equipped with advanced technologies such as high-resolution optical cameras, LiDAR sensors, thermal imaging systems, GPS navigation, artificial intelligence-enabled flight controllers, and automated data collection software. Such capabilities allow drones to perform surveying, mapping, crop monitoring, infrastructure inspection, security surveillance, aerial delivery, and cinematography with high precision and efficiency.

In Europe, commercial drones have gained widespread acceptance due to increasing urbanization, the rise of smart cities, and the growing need for automation across multiple sectors. Agricultural enterprises use drones for precision farming and crop analysis, while construction and energy companies rely on UAVs for land surveying and asset inspections. Logistics providers are testing drone delivery models, particularly in rural and remote regions. Strong research and development activity, combined with collaboration between startups, academic institutions, and aerospace manufacturers, continues to accelerate innovation within the European drone market.

Growth Drivers in the Europe Commercial Drone Market

Industrial Digitalization and Data-Driven Operations

One of the most important growth drivers for the Europe commercial drone market is the rapid pace of industrial digitalization. Organizations increasingly require accurate, real-time data to optimize operations, improve safety, and reduce costs. Drones equipped with advanced imaging and sensing technologies provide high-quality aerial data for industries such as construction, mining, utilities, transportation, and energy.

By replacing labor-intensive and hazardous inspection tasks, drones significantly improve workplace safety and operational efficiency. The European Union’s focus on digital transformation, smart infrastructure, and industrial automation further encourages the adoption of UAV technologies for asset monitoring, mapping, and remote inspections. Ongoing investments by aerospace and defense firms in drone innovation also contribute to market expansion.

Expanding Applications in Agriculture and Environmental Monitoring

Agriculture represents one of the most rapidly growing application areas for commercial drones in Europe. UAVs equipped with multispectral and hyperspectral sensors enable farmers to monitor crop health, soil conditions, irrigation performance, and pest activity. Precision agriculture supported by drones helps optimize the use of fertilizers, pesticides, and water, reducing costs while improving sustainability.

Environmental agencies and conservation organizations also rely heavily on drones for forestry management, wildlife tracking, habitat monitoring, and climate research. Europe’s strong focus on environmental protection and sustainable land use makes drones an essential tool for low-impact data collection. As climate variability increases, UAV-based monitoring and predictive analytics are becoming critical for ensuring agricultural productivity and environmental compliance.

Supportive Regulations and Growing Investments

Europe has made significant progress in harmonizing drone regulations through the European Union Aviation Safety Agency (EASA), providing clearer operational guidelines for commercial drone use. These unified frameworks facilitate cross-border operations and encourage broader adoption of UAV technologies.

At the same time, increasing public and private investments are strengthening the regional drone ecosystem. Funding is being directed toward drone research, pilot training programs, urban air mobility trials, drone corridors, and autonomous flight testing environments. Venture capital participation and partnerships between startups and established aerospace companies are accelerating advancements in autonomous navigation, battery efficiency, and payload capabilities.

Challenges in the Europe Commercial Drone Market

Regulatory Complexity and Airspace Integration

Despite regulatory progress, compliance complexity remains a major challenge. Commercial drone operators must adhere to strict requirements related to pilot certification, operational categories, flight permissions, and no-fly zones. Differences in interpretation of EU-level regulations across countries can complicate cross-border operations.

Urban deployments, particularly beyond visual line-of-sight (BVLOS) operations, face additional safety and administrative hurdles. Integrating drones into existing air traffic management systems while ensuring safe coexistence with manned aviation continues to slow large-scale adoption.

Technical Limitations and Privacy Concerns

Technical constraints such as limited battery life, payload capacity, and weather sensitivity restrict certain high-end industrial applications. Continuous innovation is required to support long-range, heavy-payload, and all-weather drone operations.

Public concerns related to data privacy, surveillance, and noise pollution also affect market acceptance. Compliance with the General Data Protection Regulation (GDPR) and transparent data governance practices are essential for building public trust and enabling wider commercial drone deployment.

Europe <2 Kg Commercial Drone Market

The <2 kg weight segment represents one of the fastest-growing categories in the Europe commercial drone market. Lightweight drones are widely used for mapping, aerial photography, inspection, and training due to their affordability, portability, and simplified licensing requirements. These drones are particularly suitable for small businesses, surveyors, agricultural consultants, and media professionals.

Technological advancements in camera quality, flight stability, and autonomous features continue to enhance the performance of lightweight drones. Improved battery efficiency allows longer and more reliable missions, making this segment highly attractive across multiple industries.

Europe Commercial Drone Hardware Market

The hardware segment forms the foundation of the European commercial drone industry and includes UAV platforms, sensors, cameras, batteries, and payload systems. Continuous innovation in LiDAR, thermal imaging, AI-enabled processors, and lightweight materials significantly improves operational accuracy and mission efficiency.

European manufacturers and global drone brands supply specialized hardware solutions tailored to agriculture, inspection, security, and delivery applications. Although hardware remains capital-intensive, it is essential for enabling high-performance, autonomous, and data-driven drone operations across industries.

Europe Fixed-Wing Commercial Drone Market

Fixed-wing drones play a crucial role in long-range mapping, environmental monitoring, border surveillance, and large-scale agricultural analysis across Europe. Their aerodynamic design allows for extended flight endurance and broader area coverage compared to multi-rotor drones.

These drones are particularly valuable in rural and industrial settings where large land areas require detailed geospatial analysis. Despite requiring more space for takeoff and skilled operators, fixed-wing UAVs remain indispensable for large-scale commercial missions.

Europe Semi-Autonomous Commercial Drone Market

Semi-autonomous drones combine manual control with automated features such as waypoint navigation, obstacle avoidance, and return-to-home functions. This segment is expanding rapidly due to its balance between operational efficiency and regulatory feasibility.

Semi-autonomous systems reduce pilot workload, improve mission accuracy, and enhance safety, making them ideal for mapping, inspections, and delivery services. Ongoing improvements in AI algorithms and flight-planning software are expected to sustain growth in this segment.

Europe Mapping and Surveying Commercial Drone Market

Mapping and surveying remain among the most mature and high-value applications for commercial drones in Europe. UAVs equipped with LiDAR and photogrammetry tools produce highly accurate 2D and 3D maps for construction, mining, land development, and infrastructure planning.

Compared to traditional surveying methods, drones significantly reduce time, cost, and safety risks. Increasing adoption of digital twins and smart infrastructure further strengthens demand for UAV-based geospatial data solutions.

Europe Commercial Drone Agriculture Market

Agriculture continues to be one of the most promising long-term applications for commercial drones in Europe. Farmers use UAVs for crop monitoring, disease detection, irrigation management, and yield optimization. Targeted spraying enabled by drones reduces chemical usage and environmental impact.

As European agriculture faces challenges related to climate change and labor shortages, drones provide actionable insights that support productivity, sustainability, and efficient land management.

Europe Security and Law Enforcement Commercial Drone Market

Security and law enforcement agencies across Europe increasingly deploy drones for surveillance, crowd monitoring, traffic management, and search-and-rescue missions. Equipped with thermal sensors, night-vision cameras, and real-time video transmission, drones enhance situational awareness while reducing risks to personnel.

Despite ongoing privacy concerns, the operational benefits of drones in emergency response and public safety continue to drive adoption.

Country-Level Insights

France leads the European commercial drone market, supported by strong aerospace capabilities, favorable government policies, and extensive R&D activity. Italy shows strong adoption in agriculture, cultural heritage preservation, and infrastructure monitoring. The United Kingdom remains one of the most advanced markets due to its supportive regulatory environment, innovation programs, and high industrial demand for UAV solutions.

Competitive Landscape and Company Analysis

The Europe commercial drone market is highly competitive, with both global and regional players offering specialized solutions. Key companies operating in the market include:

· Aeronavics Ltd.

· AeroVironment Inc.

· Autel Robotics

· Delair

· Insitu Inc.

· Leptron Unmanned Aircraft Systems Inc.

· PrecisionHawk Inc.

· SenseFly

· Skydio Inc.

· Yuneec International

Each company is analyzed across four viewpoints: overview, key personnel, recent developments, and revenue performance, providing a comprehensive assessment of competitive positioning.